As much as I have talked about my private student loans over the course of two books and countless articles, you’d think I would be a lot happier about finally reading the words, “Congratulations! Your private student loan is paid in full.”

Up until 2020, there hadn’t been a single year in which the burden of the debt attached to those loans didn’t reduce me to anger and tears of frustration at least once. In several of those years, those moments took place on multiple occasions — and were followed by dark, depressive periods. I could not have predicted that the economy I was going to graduate into in the late 2000s would make financial circumstances even more volatile. Nor could I have foreseen that the lender would be as mean and merciless as legally allowed.

All I knew was that I wanted to have the kind of opportunities usually enjoyed by people who often don’t know how good they have it. To not have my destiny determined by the socioeconomic class I was born into. I wish I had entered college with far less naivete about how social mobility really works in America for some of us darker folks, but I had good institutions.

Still, in my pursuit of a better life, which I hoped could eventually extend to my family, I spent enough of my adulthood paying for those financial sins in ways that sometimes made me not want to have a life at all.

As of this week, that burden is no longer.

It’s not like I’m completely free of student loan debt. I still owe (that bitch) Navient some money for that extra year at Howard and those government loans that have since ballooned in interest. But private student loans have given me my greatest troubles, because the terms are not at all flexible, so I am grateful that I was able to pay off the main demon — in this case, Discover Student Loans — earlier than planned.

The thing is, I don’t feel as triumphant about it as I thought I would, in large part because my feelings about money continue to be shaped by fear.

The executive and legislative branches of the U.S. government have already made clear that they are willing to let average Americans die from the coronavirus — and look away as millions more suffer from the food and housing crises resulting from the pandemic. I am proud to have made some professional advancement this year despite that, but good times can quickly go away in times of great uncertainty. I can’t hear the words “budget cuts” or learn that an outlet I write for is having trouble with payroll, because it immediately takes me back to a place resulting in me being harassed day and night and threatened with defaults and financial ruin for both me and my mama, who co-signed my loans.

I have given up so much to pay those loans. Not simply trips back home or vacations, but sometimes meals, to say nothing of concepts like “investments in myself.”

Student loan debt is a problem many share but don’t talk about, which is why I wrote a book about my struggles. With this being the second financial crisis of my adulthood, I have done everything I could this year to avoid returning to the bad old days. An existence that was marked by daily worry about whether I was doing enough to stay afloat, whether I could manage not to fall too far behind.

I’m glad that after so many years of struggle, I have made some real headway, but I can’t help but think of most people not being as fortunate. Although most Americans live in a state of great financial fragility, we can be cruel to the folks who first fall behind. People need help. We still live in a country that won’t even allow student loan debt to be discharged in bankruptcy — to the astonishment of our own Federal Reserve chair.

That’s why I say (and this is coming from someone who has already paid off more than $100,000 and still has some debt left to go): Joe Biden should cancel as much student loan debt as the powers of the presidency allow.

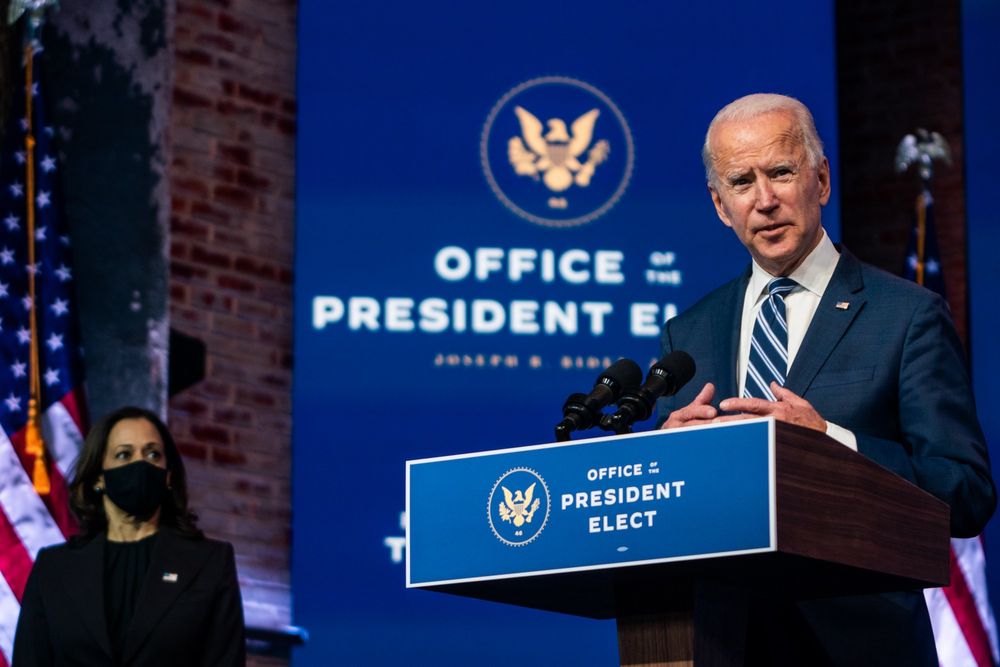

On the campaign trail, Biden had said he would forgive $10,000 in student debt for all borrowers — and this week, speaking to reporters about economic recovery at The Queen in Wilmington, Delaware, the president-elect reiterated that commitment.

$10,000 is cute and all, but in the grand scheme of things, that ain’t really worth shit, and everyone with a federal student loan knows it.

When asked if canceling student loan debt figured into his plans for the economy and if he would do so via executive action, Biden said, “It does figure in my plan. It’s holding people up. They’re in real trouble. They’re having to make choices between paying their student loans and paying their rent, those kinds of decisions. It should be done immediately.”

Although Biden signaled an openness to debt cancellation, he did not explicitly say how he would do so — or whether he supported canceling all student loan debt. Like, $10,000 is cute and all, but in the grand scheme of things, that ain’t really worth shit, and everyone with a federal student loan knows it. A lil’ nip at the interest, maybe. Not to sound ungrateful, but that just feels like something the incoming administration should probably know.

That’s why I’m not the only one who wants to know how much higher Joe is willing to go.

Others, including the current Senate minority leader, are calling on Biden to do more than what he’s presently offering. In a recent interview, Chuck Schumer argued that Biden’s 100 first days as president should mirror the actions made by former president Franklin D. Roosevelt rather than his more centrist Democratic contemporaries.

Speaking on the need to address wealth and income inequality, Schumer said we should be “getting rid of student debt.” He added, “I have a proposal with Elizabeth Warren that the first $50,000 of debt be vanquished, and we believe that Joe Biden can do that with the pen as opposed to legislation.”

Just this week, Warren echoed that sentiment.

https://twitter.com/ewarren/status/1328426591773450242

Outstanding student loan debt has doubled over the past decade, nearing $1.7 trillion. About one in six American adults owes money on federal student loan debt, which is the largest amount of non-mortgage debt in the United States. The U.S. Department of Education has granted student loan borrowers a break from their bills until the end of the year, but they don’t need a break — they need to be freed from those debts.

Should Congress be working on this? Yes. Will it? Given how difficult a new coronavirus relief package seems to be, I’m guessing that’s unlikely. But even if the Democrats get control of the Senate (a slim chance, but I’m holding out hope), that shouldn’t stop Joe Biden from using his powers to remedy a societal ill.

As others have highlighted, Biden would face legal challenges on such executive execution. If the Supreme Court can allow Donald Trump to recklessly divert appropriations money to stupid vanity projects like the border wall that Mexico was supposed to pay for, though, they can shut up when a future challenge presents itself here.

And as Bernie Sanders pointed out, “If we can provide over $1 trillion in tax breaks to the top 1% and large corporations and $740 billion for the bloated Pentagon, please don’t tell me that we cannot afford to cancel all student debt and make public colleges and trade schools tuition-free and debt-free for all.”

(But y’all didn’t want the revolution!)

Critics have argued that canceling student loan debt would add even more to the national deficit. There is also the position that millions of Americans who didn’t go to college or who paid off their debts will be angered by others having their debts potentially erased.

I say fuck them today, fuck them tomorrow, and fuck them every day thereafter. All objections to Biden canceling student loan debt on any level are dumb and selfish. I invite anyone with this line of thinking to fuck off with interest. The sooner the better, preferably.

There has long been a boom in the cost of college that doesn’t reflect an increase in wages, resulting in skyrocketing student loan debt. Black people have higher college debt than White people, but White high school dropouts are actually still wealthier than Black college graduates. Plenty of studies have already confirmed the collective benefit that debt cancellation would have for the U.S. economy — especially now that we are in this seemingly never-ending pandemic.

Those who continue to oppose student loan debt cancellation despite the favorable evidence do so because they think if they had to suffer, so should the rest. It’s an individualistic, inherently American way of looking at things. Americans love to repeat fables — “if you work hard, you, too, can one day become a rich asshole” is a popular one — but that kind of mythology isn’t as comforting as clearing someone’s bills.

If you can’t learn to be more considerate of the plights of others in a year of massive racist unrest, financial instability, and a plague, there is not much I can say to convince you otherwise — but it sounds like Joe Biden still needs some convincing. So it’s time for the Democrats to take an all-hands-on-deck approach. To stop being afraid of doing the right thing and actually do it.

One of Joe Biden’s main campaign pledges was to “restore the soul of the nation,” which never made a lot of sense to me, a Black man from the South, but I let Joe cook with it. Now that he’s president-elect, if he truly wants to uplift the country in a meaningful way, he can spare us the unrealistic rhetoric and do something that would boost the fortunes of most Americans.

It would not immediately fix all of our country’s ills, or even all problems related to student debt — the president can’t do anything about private loans — but it would be the kind of step forward that instantly changes people’s lives for the better. If Biden is committed to such a lofty goal, there’s no better time to start than his first day in office.